ATTENTION:

If You Want to Own Your Home!

ARE YOU READY TO GO FROM...

RENTER TO

HOMEOWNER

IN 6 MONTHS OR LESS

Our renter to home owner transformation program has helped over 1,000+ people hit their goals!

**SATISFACTION GUARANTEED, IF WE DON'T REMOVE IT, YOU DON'T PAY!**

OUR EXCLUSIVE HOME BUYER TRANSFORMATION PROGRAM PROVIDES YOU WITH:

Secrets to increase your score FASTER than you thought possible.

Little known hacks to boost credibility virtually overnight!

How to qualify for HIGH LIMIT lines

THE EXACT blueprint our clients use to eliminate ALL the negative remarks quickly and legally!

SO YOU CAN...

Buy or Refinance Your Home

Purchase a new vehicle

Qualify for a Better Job

Move into a Better Apartment

Reduce Stress in Your Relationship

Get Approved for Cards (At low rates)

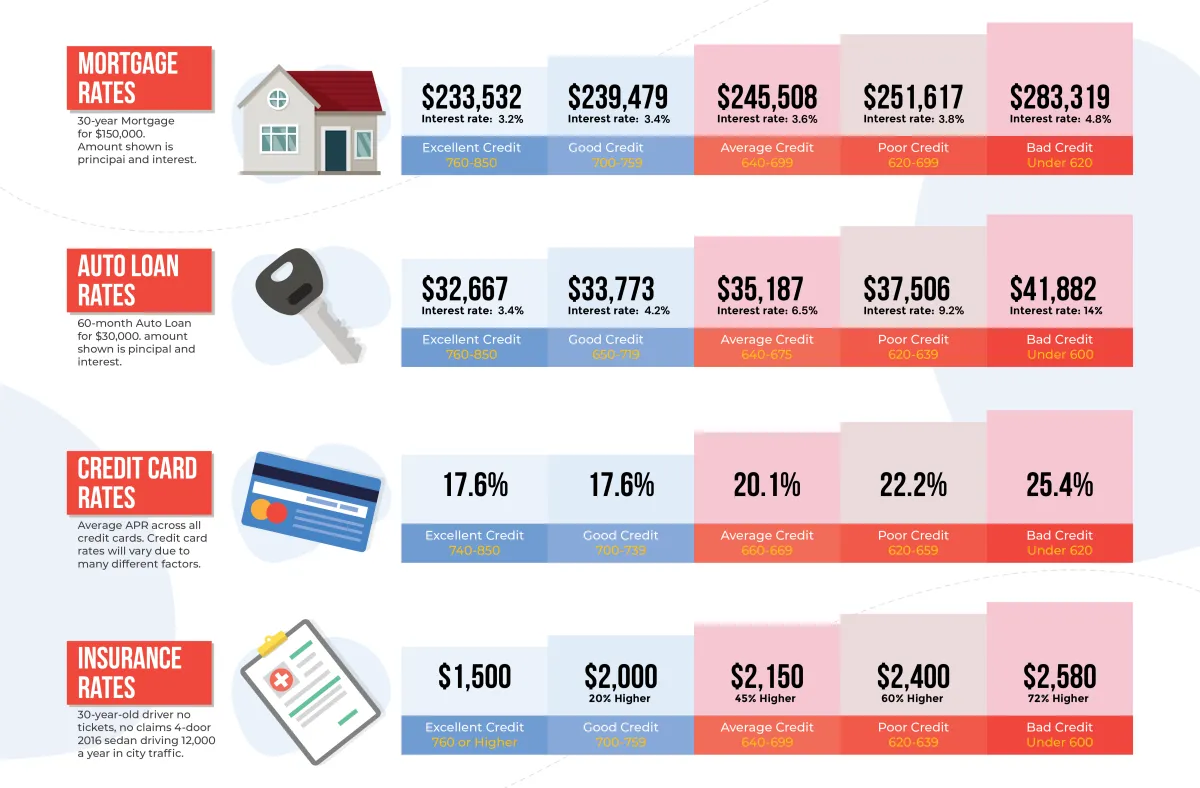

Save Thousands of Dollars a Year

Lower Insurance Payments

Lower Car Payments

The BEST Interest Rates

- Here's some stuff

WHAT ARE THE TRUE COSTS?

WE WILL GET YOU IN YOUR FIRST HOME!

YOU'RE ONE STEP CLOSER TO BECOMING A FIRST TIME HOME BUYER

THE PROCESS

STEP 1:

Click the button below to START your transformation program TODAY!

*Spaces for the transformation program are extremely limited.*

STEP 2:

Join the Family and instantly start improving1

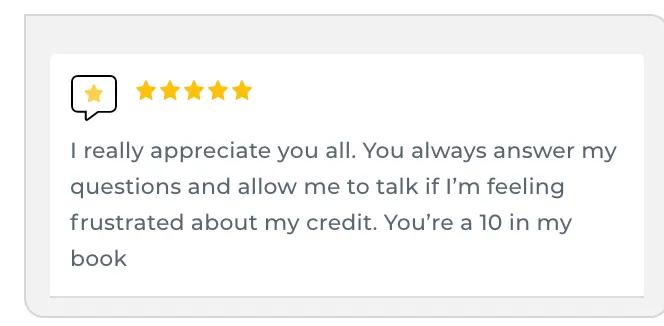

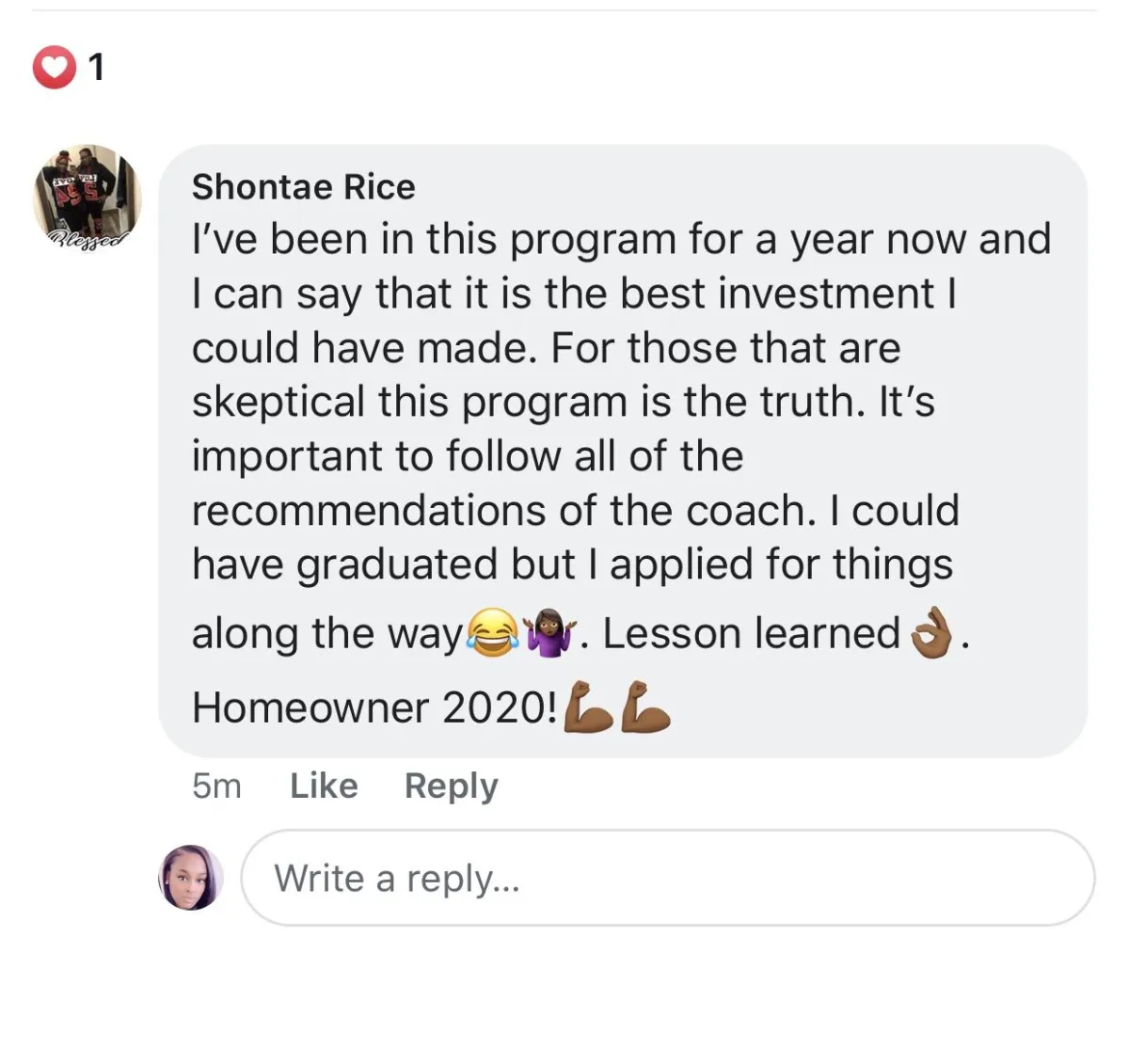

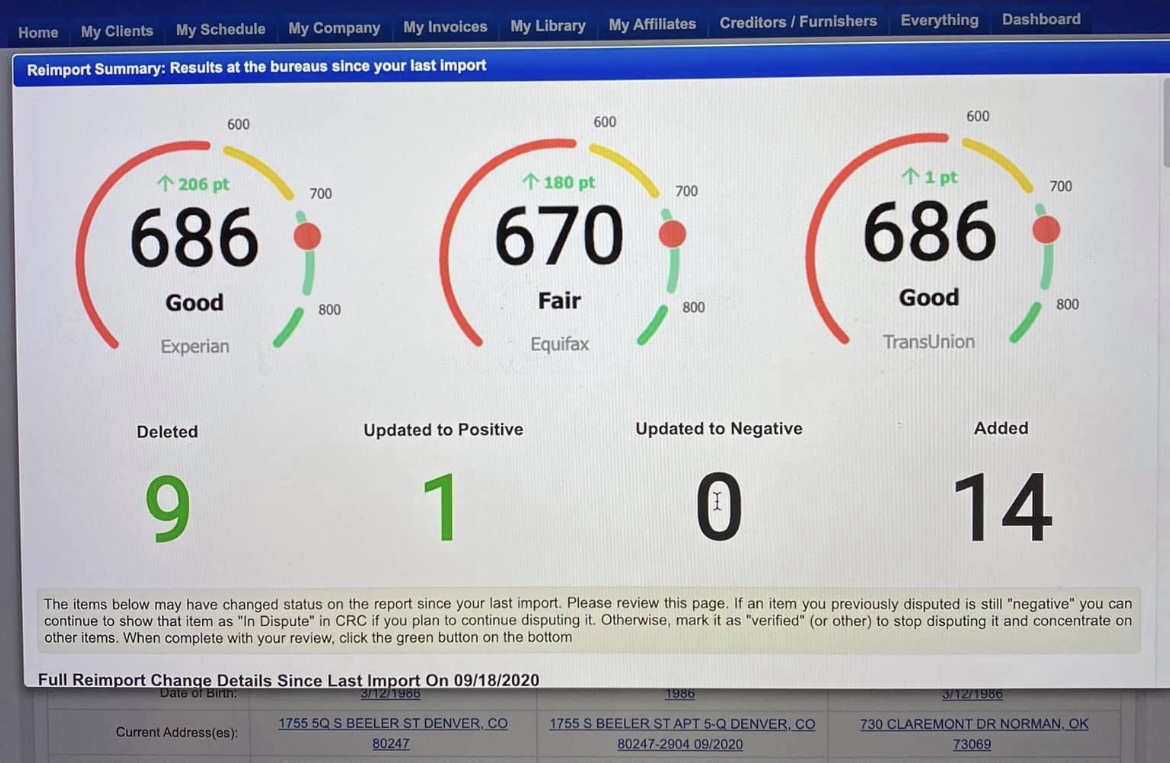

CHECK OUT SOME PROGRESS FROM A FEW OF OUR CUSTOMERS

CLICK THE BUTTON BELOW TO START YOUR RENTER TO HOME OWNER TRANSFORMATION PROGRAM TODAY!

WE KNOW EVERYTHING THAT YOU NEED

WE KNOW THE DIFFICULTY MAINTAINING A HEALTHY FINANCIAL LIFESTYLE THAT WORKS FOR YOU. WE LEARN TO UNDERSTAND YOU AND WHAT YOU NEED, AND HANDLE THE REST!

FREE AUDIT

REPAIR

SAVE MONEY

WE HELP YOU QUALIFY FOR YOUR DREAM HOME!

SEE IF YOU QUALIFY FOR OUR RENTER TO HOME OWNER TRANSFORMATION PROGRAM NOW!

Spots are limited - APPLY NOW!