Maintaining a good credit score is essential for anyone seeking financial stability. Your credit score affects loan approvals, interest rates, rental applications, and sometimes even job prospects. But what exactly constitutes a good credit score, and how can you ensure yours remains within this range? In this guide, we’ll explore the best percentage of a good credit score, how it is calculated, and how you can improve yours. We’ll also explain why Credit Friendly Solutions can be your trusted partner in managing and improving your credit score.

What is a Good Credit Score?

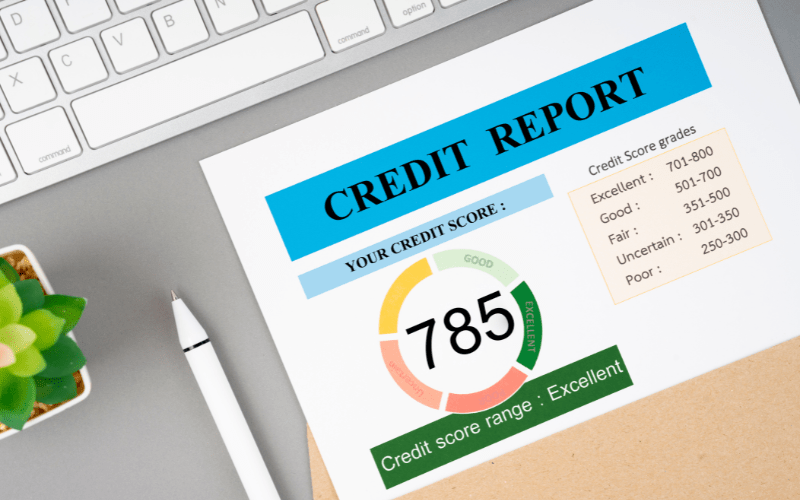

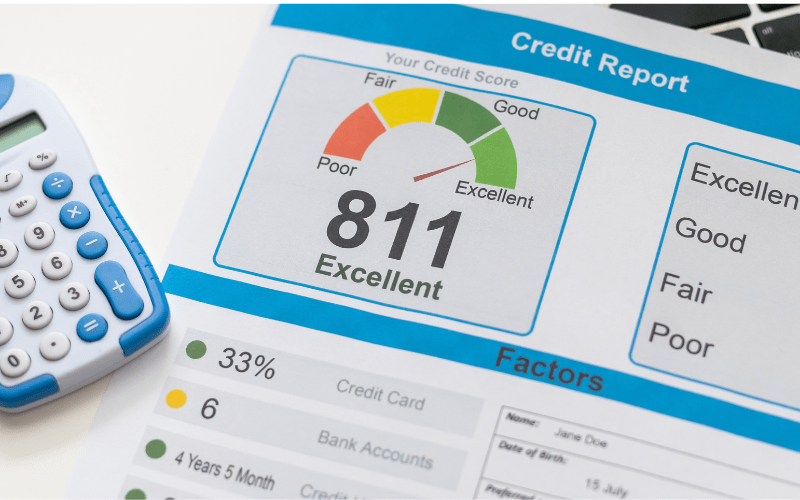

Your credit score is a numerical representation of your creditworthiness. It’s a way for lenders, banks, and financial institutions to assess how likely you are to repay debts on time. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. But what exactly qualifies as a “good” score?

For most scoring models, including FICO and VantageScore, a score of 670 to 739 is considered good. However, the higher your score, the better your financial opportunities.

Credit Score Ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

For those aiming for the best financial terms, the goal should be to get their score into the 740+ range, where you’ll start seeing lower interest rates, better credit card offers, and more favorable loan terms.

The Ideal Percentage for a Good Credit Score

Understanding how many people achieve good or excellent credit scores is important. According to recent studies, around 40% of Americans have a credit score of 740 or higher, which is considered very good. While only a smaller percentage have an 800+ score, which is excellent, having a credit score above 670 is sufficient to qualify for most loans, albeit at slightly higher interest rates.

If you’re looking for better interest rates and favorable terms, aiming for the top 25-30% of credit scores, where people maintain scores above 740, should be your goal.

Factors that Impact Your Credit Score

Understanding the factors that go into calculating your credit score can help you make the right moves to improve it. Credit scoring models like FICO and VantageScore use various factors to determine your score. Here’s the breakdown:

- Payment History (35%): This is the most critical factor. Paying your bills on time shows lenders that you are responsible for your finances. A single late payment can significantly damage your credit score.

- Credit Utilization (30%): This refers to how much of your available credit you are using. A high credit utilization ratio can lower your score. Most experts recommend keeping your credit utilization below 30% of your available credit.

- Length of Credit History (15%): The longer your credit history, the better. This is why it’s often beneficial to keep older accounts open.

- New Credit Inquiries (10%): Too many credit inquiries can signal to lenders that you’re a risk. Try to minimize the number of times you apply for new credit within a short period.

- Credit Mix (10%): Having a diverse range of credit accounts, such as credit cards, mortgages, and auto loans, can slightly improve your score.

Why 30% Credit Utilization Ratio Matters

One of the quickest ways to improve your credit score is by managing your credit utilization ratio. This ratio compares the amount of credit you are using to the total amount of credit available to you. The golden rule is to keep this ratio below 30%. For example, if your credit card limit is $10,000, you should aim to use no more than $3,000.

Keeping your utilization low signals to lenders that you are managing your credit well, and it can contribute significantly to improving your score.

How to Improve Your Credit Score

Improving your credit score requires consistent effort. Here are a few steps you can take to boost your score:

- Pay Bills on Time: Your payment history accounts for the largest portion of your credit score. Setting up automatic payments or reminders can help you avoid missed payments.

- Reduce Debt Balances: Try to pay off credit card debt, particularly on cards with high balances, as soon as possible. Reducing your overall debt will improve your credit utilization ratio.

- Limit Credit Inquiries: Be cautious about applying for new credit frequently. Every inquiry adds a hard inquiry to your report and can temporarily lower your score.

- Maintain Old Accounts: The length of your credit history plays a role in your score. Avoid closing old accounts as they add to the overall age of your credit profile.

Partnering with a credit repair service like Credit Friendly Solutions can make a big difference. Their expert team can help identify areas of improvement, correct errors on your credit report, and guide you toward building a higher score.

Common Myths About Good Credit Scores

There are a lot of misconceptions about what helps or hurts your credit score. Let’s clear up a few common myths:

- Myth 1: Closing old accounts improves your score

In reality, closing old accounts can lower your score by reducing the length of your credit history. Keep older accounts open, even if you don’t use them. - Myth 2: Checking your score lowers it

Checking your credit report is considered a “soft inquiry” and has no impact on your credit score. - Myth 3: Income affects your credit score

Income is not a factor in your credit score calculation. However, having a higher income can help you manage debt better.

Frequently Asked Questions (FAQs)

- What is considered a good credit score?

A good credit score typically falls between 670 and 739. If you’re above 740, you have a very good or excellent score. - What percentage of the population has a good credit score?

Around 40% of Americans have a credit score of 740 or higher. About 58% have a score of 700 or above, making them eligible for most loans. - How can I improve my credit score quickly?

The fastest ways to improve your score include paying bills on time, reducing debt balances, and keeping your credit utilization ratio below 30%. - Does a good credit score vary by age or location?

Credit scores don’t vary by age or location directly, but younger people may have lower scores due to a shorter credit history. Location impacts may arise due to differences in the cost of living. - What is the impact of credit utilization on my credit score?

Keeping your credit utilization below 30% is ideal for maintaining or improving your score. Going above this limit can signal to lenders that you’re overextended.

Conclusion

Maintaining a good credit score is essential for financial success, and understanding what goes into calculating your score is the first step. With proper attention to your payment history, credit utilization, and other factors, you can improve your credit score over time. Aiming to keep your credit utilization below 30% and staying on top of payments will give you the best chance of reaching and maintaining a score in the top 25% of Americans.

When you need expert guidance, Credit Friendly Solutions is here to help. Whether you’re aiming to improve your score or correct errors in your credit report, our team offers personalized solutions to help you achieve your financial goals. Let Credit Friendly Solutions assist you in unlocking better financial opportunities today!