In today’s complex financial world, many people struggle with debt and financial management. If you’re facing challenges with your credit and debt, credit counseling services in California can offer substantial help. Credit Friendly Solutions explains why credit counseling is essential and how it can transform your financial health.

Understanding Credit Counseling Services California

Definition and Purpose

Credit counseling involves working with a trained professional who helps you manage your debt and improve your financial situation. The primary goal is to educate you about financial management and create a personalized plan to get back on track. Credit Friendly Solutions offers expert credit counseling services in California to address various financial challenges.

How Credit Counseling Works

The process begins with an initial consultation where a credit counselor reviews your financial situation. This includes analyzing your credit report, income, expenses, and debts. Based on this assessment, a tailored plan is developed to address your unique needs. Credit Friendly Solutions guides you through each step, ensuring you understand and can implement the recommended strategies.

Benefits of Credit Counseling Services California

Improved Financial Management

One of the main benefits of credit counseling is enhanced financial management. Counselors at Credit Friendly Solutions teach you effective budgeting techniques and strategies for managing debt. By learning how to allocate your income wisely, you can gain control over your finances and reduce stress.

Reduced Stress

Financial problems can cause significant stress and anxiety. Credit counseling provides emotional relief by offering professional support and guidance. Knowing you have a plan and a team to support you can make a big difference. Credit Friendly Solutions helps you navigate through these stressful times with confidence and clarity.

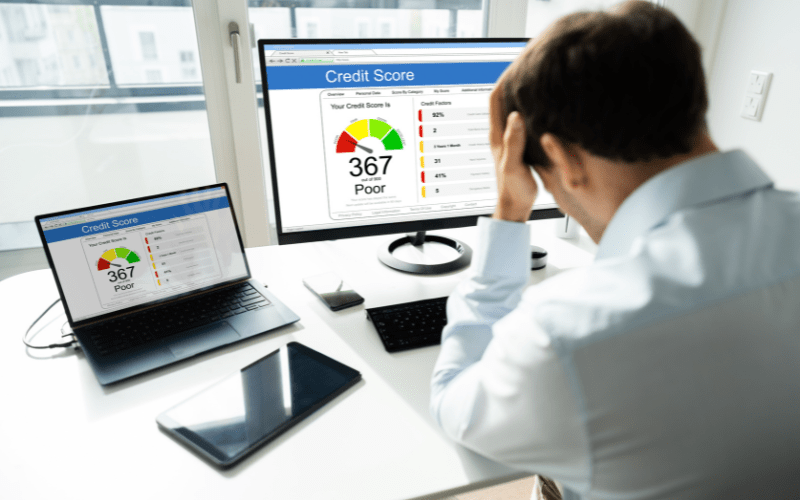

Better Credit Score

Another advantage of credit counseling is the potential improvement in your credit score. As you follow the plan created by your counselor, you’ll manage debt more effectively and make timely payments. Over time, these positive actions can lead to a better credit score and a healthier credit history. Credit Friendly Solutions focuses on long-term improvements that benefit your financial future.

Signs You Need Credit Counseling Services In California

Common Financial Indicators

Several signs indicate you might benefit from credit counseling. If you’re struggling to keep up with debt payments, accumulating credit card debt, or receiving collection calls, it’s time to seek help. Credit Friendly Solutions can assist you if you recognize these signs in your financial situation.

Behavioral Indicators

Behavioral changes can also signal the need for credit counseling. If you’re experiencing financial stress and anxiety or having difficulty managing your finances, professional help may be necessary. Credit Friendly Solutions provides support to help you address these concerns and regain control of your financial life.

How to Choose the Right Credit Counseling Services In California?

Accreditation and Credentials

When selecting a credit counseling service in California, choose one with proper accreditation and credentials. Ensure the service is certified by reputable organizations such as the National Foundation for Credit Counseling (NFCC). Credit Friendly Solutions is accredited and recognized for its quality service, ensuring you receive professional and reliable support.

Services Offered

Different credit counseling services in California offer various types of assistance. Some focus on budgeting, while others provide comprehensive debt management plans. Credit Friendly Solutions offers a range of services tailored to meet your specific needs, whether you need help with budgeting, debt repayment, bankruptcy credit counseling, or financial education.

Client Reviews and Testimonials

Researching client reviews and testimonials can provide insights into the effectiveness of a credit counseling service. Look for feedback from individuals who have used the service and evaluate their experiences. Credit Friendly Solutions has numerous positive testimonials from clients who have successfully improved their financial situations through our services.

The Process of Credit Counseling Services In California

Initial Assessment

The credit counseling process starts with an initial assessment where the counselor reviews your financial situation in detail. You’ll discuss your income, expenses, debts, and financial goals. Credit Friendly Solutions ensures this assessment is thorough, providing a clear understanding of your current financial status.

Developing a Financial Plan

After the assessment, your counselor will create a personalized financial plan. This plan includes budgeting strategies, debt repayment methods, and steps to improve your credit score. Credit Friendly Solutions works closely with you to develop a plan that fits your financial situation and goals.

Follow-Up and Support

Credit Counseling Services California doesn’t end with the creation of a financial plan. Regular follow-ups and support are crucial to ensure you stay on track. Credit Friendly Solutions provides ongoing support, including periodic check-ins and updates to help you make adjustments as needed and stay focused on your financial goals.

Success Stories and Case Studies

Real-life examples of individuals who have benefited from credit counseling can be inspiring. Many people have successfully overcome financial challenges and improved their credit scores with the help of credit counseling services. Credit Friendly Solutions is proud to have helped numerous clients achieve financial stability and peace of mind.

Common Misconceptions About Credit Counseling Services In California

Myths and Facts

There are several misconceptions about credit counseling. One common myth is that credit counseling is only for people in severe debt. In reality, credit counseling can benefit anyone looking to improve their financial management. Credit Friendly Solutions offers services for individuals at various stages of financial health, not just those in crisis.

FAQs

- What is the difference between credit counseling and credit repair?

Credit counseling focuses on managing debt and improving financial habits, while credit repair involves addressing inaccuracies on your credit report. - How long does the credit counseling process take?

The duration varies depending on individual circumstances, but the initial process typically involves a few meetings over several weeks. - Will credit counseling affect my credit score?

Initially, credit counseling might impact your credit score slightly, but over time, it can lead to improved credit as you manage debt more effectively. - Are there any costs associated with credit counseling services?

Some services may charge fees, but many offer free consultations and low-cost options. Credit Friendly Solutions provides affordable services tailored to your needs. - Can credit counseling help with student loan debt?

Yes, credit counseling can provide strategies for managing and repaying student loans effectively. Credit Friendly Solutions offers specialized advice for various types of debt, including student loans.

Conclusion

Credit counseling Services in California are a valuable resource for anyone struggling with debt or financial management. By seeking help from a reputable service like Credit Friendly Solutions, you can gain control over your finances, reduce stress, and improve your credit score. Don’t wait until financial problems become overwhelming—reach out to Credit Friendly Solutions today to start your journey toward financial stability and success.

Credit Friendly Solutions is dedicated to helping you achieve financial wellness through expert credit counseling services. Take the first step towards a better financial future by contacting us today.